There are only two sources of income – people at work and money at work. Therefore, everyone should have two sources of income:

Of the two, the Cash Flow Management System is the most important, as it will determine how efficiently we allocate our money. Money flows to where it is treated best.

There are myriad gurus, coaches, and motivational speakers who will tell you how to make more money, but what do you do with the cash once it is in your control?

No matter how much or how little income goes through our hands, having a capital efficient cash flow management system in place to assure that we get the most value from each dollar is essential to building wealth.

Who are the best money managers in the world? Institutionally, it would be the banks and insurance companies. Individually, it would be two of the world’s wealthiest people – Amazon’s Jeff Bezos and Warren Buffett of Berkshire Hathaway. What if we could emulate what they do at the “you and me” level?

Banks and Banking Systems

Banking is the most important business in the world. Without the banking function, commerce is severely restricted. Banks provide a place to conveniently store capital and provide access to capital. All money flows through a banking system.

The banking function is not well understood by most people, yet it is surprisingly simple. It is really no more complicated than buying wholesale and selling retail. Buy low, sell high. A clothing store buys t-shirts wholesale for $5, and sells them at retail for $10. A hardware store buys hammers at $8 wholesale and sells them at retail for $20. A bank does essentially the same thing, but with dollars rather than t-shirts or hammers.

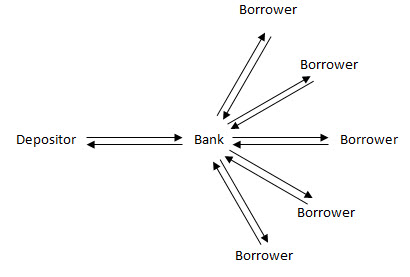

Every business has a common need to survive and flourish – a customer! The banking business needs a customer called a depositor to “lend” them money. This creates a liability to the bank and the risk of being able to pay it back to the depositor. Therefore, the bank needs another customer – a borrower!

The bank lends the borrower money to create an asset called a loan. As the borrower pays back the loan to the bank, the bank can then lend out more money with each loan payment they receive.

Notice that what we, as customers of the bank, consider an asset (our deposits), the banker considers a liability, and what we consider a liability (a loan), the banker considers an asset.

Banking systems figured out long ago that by harnessing interest and being on the right side of debt they could endure and grow for centuries.

We can set up our own scalable “banking system,” apart from the Federal Reserve System, with the principles of Sound Money (asset-based) in place.

“When you get paid for your work, you put all of it into “someone else’s bank” and then write checks from the account to buy the things in life. So “someone else’s bank” gets all of your money. If you owned a banking system, wouldn’t you want to run all of your business through your bank?” – R. Nelson Nash, author of Becoming Your Own Banker

Insurance Companies

Insurance companies are, by far, the greatest money managers in the world and are legendary compounders of capital. They earn conservative, consistent returns over long periods of time with little to no risk. Like banks, they take in “deposits” from their customers in the form of premium payments and put that money to work. In fact, a bank vice-president and insurance company vice president could swap jobs and not miss a beat.

There is one important difference, however. Unlike banks, who can leverage their capital through fractional reserve banking, an insurance company is required to have 100% of their liabilities covered in reserve. The best life insurance companies have 3 – 6 times more in their reserves than the required 100%. Therefore it is the safest place to store money. In fact, commercial banks store significant amounts of their Tier One capital reserves at insurance companies!

“Well-run insurance companies are legendary compounders of capital. No other business can compound capital so consistently. Capital efficiency builds a “moat” around a business. It is the single greatest investment secret ever discovered.”– Porter Stansberry, Stansberry Research

Well-run property & casualty insurance companies are excellent places to invest money for the long haul (see Berkshire Hathaway below). However, certain types of life insurance companies, known as mutual companies, are without question, the safest and best places to store your savings dollars. These little-known private reserve accounts* guarantee tax-deferred growth far beyond that of a bank savings account (which gains are taxable), tax-free access and liquidity, protection from liens, lawsuits and judgments in most states, and are non-reportable to the IRS. Additionally, the insurance company guarantees a line-of-credit against these accounts to use for any reason with no questions asked!

It is important to remember that life insurance, like gold, is an asset, not an investment. Both life insurance* and gold hold their value through tough times. Each may be thought of as wealth insurance.

The Single Biggest Benefit in the Tax Code

“As a tax advisor, I can tell you that the single biggest benefit in the federal tax code is the income tax exemption for [permanent] life insurance.” – Ed Slott, CPA, host of the PBS programs Retirement Rescue and Ed Slott’s Retirement Road Map!

* Participating, Dividend-paying Whole Life insurance policy with a paid-up additions (PUA) rider from a Mutual Company

Jeff Bezos and Amazon

On May 15, 1997, a money-losing online bookstore went public on the NASDAQ in an IPO that valued it at a modest $438 million.

Twenty years later, that little startup — called Amazon.com — was worth nearly $460 BILLION. Just one year after that, it was worth nearly $897 billion, and is on track to become the next (after Apple) $1 trillion company.

The incredible thing about Amazon from 1997 to 2017 is that revenue increased every single year from just $150 million to about $178 billion in 2017, and jumped nearly 40% year over year from 2017 to 2018. Operating cash flow also increased, almost every year, from around $1 million to an estimated $18 or $19 billion in 2017. Net income rose nearly 1,200%, from $197 million in the second quarter of 2017 to a record $2.5 billion in the second quarter of 2018.

To get there, the Seattle-based giant pumped nearly all of the cash that it generated into acquiring new assets. With a focus on growth over net income, Jeff Bezos’ company has penetrated industry after industry at a pace perhaps unmatched in modern history.

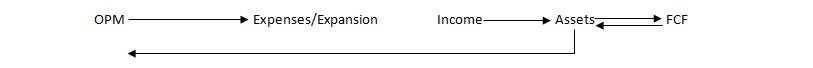

The reason Amazon is so wildly successful—and Jeff Bezos is rich—is because he practices a different kind of discipline when it comes to money. Bezos practices the discipline of using other people’s money (OPM) in acquiring assets which pay for his expenses and expansion. His income now is free to generate Free Cash Flow (FCF), and use that income to buy even more assets that generate even more passive income.

For much of Amazon’s first 20 years, it was often ridiculed for “not being profitable.” By this people meant that it didn’t post positive net income. However, Amazon’s lack of net income wasn’t due to poor business practices or a poor business plan. Instead, Jeff Bezos intentionally focused on cash flow and growth over net income. He was (and is) constantly acquiring new assets that produce greater cash flow in order to buy more assets. As a result, growth is exponential – “up and to the right!”

Warren Buffett says not buying Amazon was one of his biggest mistakes:

“I did not think [founder Jeff Bezos] could succeed on the scale he has. [I] underestimated the brilliance of the execution.” – Warren Buffett

To emulate Amazon’s model at the “you and me” level, spending means treating asset acquisition like an expense—and making it your most important expense.

This “pay yourself first” mentality of the wealthy takes discipline when it comes to saving money, but it takes even greater discipline to spend it on assets and to do so intelligently.

Warren Buffett and Berkshire Hathaway

For over 50 years, Warren Buffett and Berkshire Hathaway has been the gold standard by which every other investor is measured. Yet most focus on the stocks or businesses in his portfolio and invest in the same. This is only part of the equation, however. The most important wealth creating secret is hiding in plain sight in Berkshire Hathaway’s annual reports.

“I never attempt to make money on the stock market. I buy on the assumption that they could close the market and not reopen it for five years.” – Warren Buffett

Inside every annual report, Buffett invokes a significant discussion about “our most important sector, insurance.” He explicitly acknowledges that the insurance businesses generate large volumes of capital which he uses to finance his other businesses. This money is called “float.” Float is the difference between premiums collected and claims paid out by an insurance company. This money may be used by the insurance company to invest.

“Without a doubt, Berkshire’s largest unrecorded wealth lies in its insurance business. We’ve spent 48 years building this multi-faceted operation, and it can’t be replicated.” It is “money that doesn’t belong to us, but that we can invest for Berkshire’s benefit . . .” (2015)

(To clarify, when Buffett states that “it can’t be replicated,” he means the characteristics of insurance can’t be replicated by any other asset. The model, however, is absolutely replicable, as we shall see.)

“One reason we were attracted to the P/C (property & casualty insurance) business was its financial characteristics: P/C insurers receive premiums upfront and pay claims later. This collect-now, pay-later model leaves P/C companies holding large sums of money we call ‘float’ that will eventually go to others. Meanwhile, insurers get to invest this float for their own benefit. Though individual policies and claims come and go, the amount of float an insurer holds usually remains fairly stable in relation to premium volume. Consequently, as our business grows, so does our float.”

Insurance float is so valuable that insurance companies often operate at an underwriting loss – that is, the premiums received are not enough to cover the eventual losses (hurricanes, car accidents, etc.) that must be paid and the expenses required to resolve those claims, operate the business, etc.

Why would an insurer operate at a loss? Again, because the insurer can invest the insurance float and make even more money. In this sense, insurance float is like a loan and the underwriting loss is like the interest rate on that loan (i.e. cost of capital).

Now, for most insurers the cost of float is usually a few percentage points. Berkshire Hathaway’s insurance operations, however, are so well run that the company’s historical cost of float has actually been positive. . . meaning Berkshire Hathaway is actually being paid to take other people’s money! (Vintage Value Investing https://www.valuewalk.com/2017/04/warren-buffett-used-insurance-float-become-second-richest-person-world/)

“The Berkshire formula was to own high-quality property and casualty (P&C) underwriting companies that would generate a lot of cash. This gave Buffett a large and growing pot of money to invest. (“Float” is the term in the insurance world for this capital that Berkshire controls.) This capital was then reinvested in conservative businesses that were highly capital-efficient – or as Buffett would say, possessed a lot of “economic goodwill.” These firms, in turn, would grow and greatly increase the dividends they paid to Berkshire, which would then buy still bigger insurance companies.

You can think of this system as a kind of capital compounding machine, where money from insurance-company float was piled into capital-efficient businesses capable of long-term growth… whose escalating dividends could be used to buy still larger insurance companies… providing still more capital to invest… again and again.

“No better model for generating wealth ever existed in all of capitalism.” Porter Stansberry, Stansberry Research

“If Buffett is the Thor of investing, then the insurance float he references here is surely his hammer — it provides him with the capital power to really amplify his good decisions.” – Luke Kawa 2/25/2017

“The Berkshire Hathaway insurance float model is clearly genius.”

– Business Insider, Vintage Value Investing, 4/12/2017

Putting It All Together to Create a Scalable Cash Flow Management System

The components to create our Cash Flow Management System are now in place.

Our Cash Flow Management System allows you to: